ETFGI reported that currency hedged ETFs and ETPs listed globally gathered net inflows of US$3.10billion during February bringing year to date net inflows to US$7.17 billion……..

Sign up to our free newsletters

By Deborah Fuhr, Managing Partner at ETFGI

Total assets invested in currency hedged ETFs and ETPs decreased by 2.2% from US$181 billion to US$177 billion, with a 5-year CAGR of 21.3%, according to ETFGI’s February 2020 Currency hedged ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

Currency hedged ETFs/ETPs gathered net inflows of $3.01 billion during February.

The $177 billion invested in currency hedged ETFs / ETPs listed globally at the end of February is the 3rdhighest on record

“At the end of February, the S&P 500 was down 8.2% as coronavirus cases continued to spread and the potential economic impact weighed on investors and the markets. Outside the U.S., the S&P Developed ex-U.S. BMI declined nearly 9.0%. The S&P Emerging BMI lost 5.1% during the month. Global equities as measured by the S&P Global BMI ended down 8.1% with 49 of 50 included country indices down, while China gained 0.9%.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of February 2020, there were 783 currency hedged ETFs/ETPs, with 1,709 listings, assets of $177 billion, from 73 providers listed on 29 exchanges in 22 countries. Following net inflows of $3.10 billion and market moves during the month, assets invested in currency hedged ETFs/ETPs decreased by 2.2%, from $181 billion at the end of January to $177 billion.

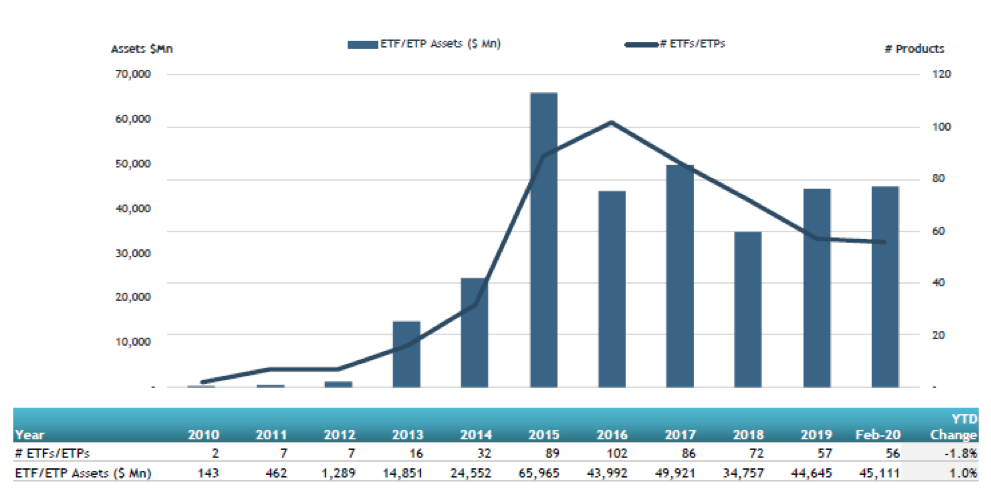

Growth in the US currency hedged ETF and ETP assets as of the end of February 2020

At the end of February 2020, there were currency hedged ETFs/ETPs hedged against 15 different currencies. Year to date, 7 new currency hedged ETFs/ETPs were launched by 13 providers across 7 index providers in 8 countries, while 7 products were delisted from 2 different providers.

During the month, Mixed exposures gathered the largest net inflows with $1.42 billion, followed by United States exposures with $1.29 billion and Global-Developed exposures with $707 million, while Asia Pacific-Developed exposures experienced the largest net outflows with $656 million. On a year to date basis, Mixed exposures gathered the largest net inflows with $2.86 billion, followed by United States exposures with $2.50 billion and Global-Developed exposures with $1.92 billion, while Asia Pacific-Developed exposures experienced the largest net outflows with $870 million.

The top 10 currency hedged ETFs/ETPs by net new assets collectively gathered $2.81 billion at the end of February.

The Vanguard Total International Bond ETF (BNDX US) gathered $976 million, the largest net inflow for the month.

Top 10 ETFs/ETPs by net new assets February 2020: Currency hedged

| Name | Ticker | Assets | ADV | NNA | NNA |

| Vanguard Total International Bond ETF | BNDX US | 27085.33 | 119.83 | 2080.56 | 976.00 |

| Mackenzie Emerging Markets Local Currency Bond Index ETF | QEBH CN | 418.25 | 11.09 | 232.62 | 228.80 |

| iShares S&P 500 EUR Hedged UCITS ETF (Acc) | IUSE LN | 3880.31 | 2.92 | 230.98 | 211.57 |

| iShares USD Treasury Bond 0-1yr UCITS ETF – Acc | TBX1 SW | 1909.09 | 0.00 | 365.18 | 165.57 |

| Xtrackers II iBoxx USD Treasuries UCITS ETF DR EUR Hedged | XUTE GY | 674.22 | 1.57 | 198.09 | 150.17 |

| iShares J.P. Morgan $ EM Bond EUR Hedged UCITS ETF (Dist) – EUR Hdg | EMBE LN | 3925.08 | 1.64 | 248.86 | 124.39 |

| UBS ETF – Bloomberg Barclays US 10+ Year Treasury Bond UCITS ETF (EUR) | UST10F SW | 209.06 | 0.01 | 121.77 | 119.74 |

| iShares $ Floating Rate Bond UCITS ETF – Acc (MXN) | FRMXNX IX | 1028.08 | 0.00 | 207.96 | 114.54 |

| iShares $ High Yield Corp Bond UCITS ETF (MXN) | IHYMXX IX | 220.36 | 0.00 | 140.06 | 96.48 |

| iShares Global High Yield Corp Bond GBP Hedged UCITS ETF (Dist) | GHYS LN | 311.40 | 0.80 | 115.49 | 87.42 |

Quelle: ETFWorld

Subscribe to Our Newsletter