Refinitiv: Despite the current situation in Ukraine, March 2022 was another positive month for the European ETF industry since promoters enjoyed inflows.

Sign up to our free newsletters

By Detlef Glow, Lipper’s head of EMEA research at Refinitiv

These inflows occurred in a volatile market environment in which investor sentiment was impacted by increasing inflation rates, geopolitical tensions and the still ongoing COVID-19 pandemic in Europe and other parts of the world.

The performance of the underlying markets led in combination with the estimated net inflows to increasing assets under management (from €1,307.1 bn as of February 28, 2022, to €1,334.1 bn at the end of March).

The increase of €27.0 bn for March was driven by the performance of the underlying markets (+€23.3 bn), while estimated net sales contributed €3.8 bn to the assets under management.

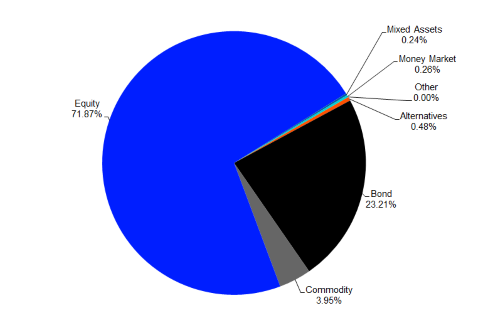

It was not surprising equity funds (€958.8 bn) held the majority of assets, followed by bond funds (€309.7 bn), commodities products (€52.6 bn), alternative UCITS products (€6.4 bn), money market funds (€3.5 bn), mixed-assets funds (€3.1 bn), and “other” funds (€0.1 bn).

Graph 1: Market Share, Assets Under Management in the European ETF Segment by Asset Type, March 31, 2022

Source: Refinitiv Lipper

Fund Flows by Asset Type

The European ETF industry enjoyed healthy estimated net inflows for March (+€3.8 bn) which were below the rolling 12-month average (€12.5 bn).

The inflows in the European ETF industry for March were driven by bond ETFs (+€2.4bn), followed by equity ETFs (+€2.0 bn), mixed-assets ETFs (+€0.1 bn), money market ETFs (+€0.03 bn), and “other” ETFs (+€0.003 bn). On the other side of table, commodities ETFs (-€0.2 bn) and alternative UCITS ETFs (-€0.6 bn) faced outflows.

This flow pattern drove the estimated overall net inflows to €9.1 bn for the month. Generally speaking, it was surprising that ETFs from all asset types enjoyed inflows for the month given the in-general negative market environment.

Source: ETFWorld

Subscribe to Our Newsletter