ETFGI reports the ETFs industry in Europe reported net outflows of US$522 million in June after 26 months of consecutive net inflows

Sign up to our free newsletters

By Deborah Fuhr, Managing Partner at ETFGI

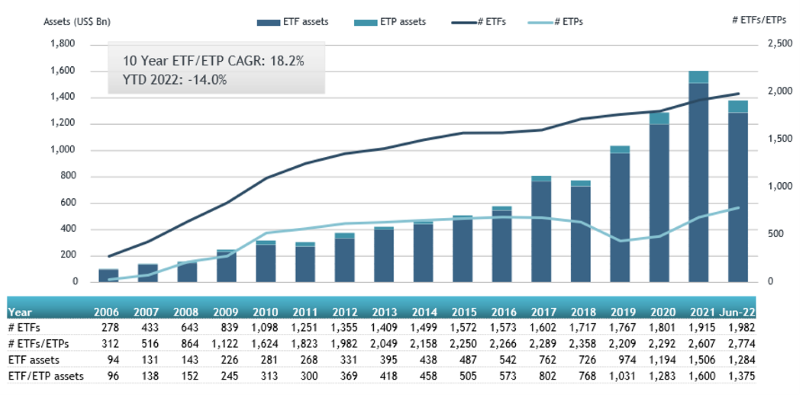

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today reports the ETFs industry in Europe reported net outflows of US$522 million in June after 26 months of consecutive net inflows, bringing year-to-date net inflows to US$68.17 billion. During the month, assets invested in the European ETF/ETP industry decreased by 7.3%, from US$1.48 trillion at the end of May to US$1.37 trillion, according to ETFGI’s June 2022 European ETFs and ETPs industry landscape insights report. (All dollar values in USD unless otherwise noted.)

Highlights

Assets of $1.37 Tn invested in ETFs and ETPs listed in Europe at the end of H1 2022.

Assets decreased 14.0% in H1 2022, going from $1.60 Tn at end of 2021 to $1.37 Tn.

Net outflows of $522 Mn in June 2022 after 26 consecutive months of net inflows.

Net inflows of $68.17 Bn are the second highest on record in H1 2022, after net inflows of

$111.97 Bn in H1 2021.

$149.84 Bn in net inflows gathered in the past 12 months.

1st month of net outflows.

Equity ETFs and ETPs listed in the Europe gathered net inflows of $50.03 Bn in H1 2022, which are the second highest on record after net inflows of $86.99 Bn in H1 2021.

““The S&P 500 decreased by 8.25% in June and is down by 19.96% in the first half of 2022. Developed markets excluding the US decreased by 9.94% in June and are down 20.09% in H1 2022. Luxembourg (down 20.27%) and Korea (down 17.54%) saw the largest decreases amongst the developed markets in June, while Hong Kong (up 1.40%) saw the largest increase. Emerging markets decreased by 5.19% during June and are down 16.12% in H1 2022. Colombia (down 24.12%) and Brazil (down 20.14%) saw the largest decreases amongst emerging markets in June, while China (up 6.53%) saw the largest increase.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of June 2022

The European ETFs industry had 2,774 products, assets of $1.37 Tn, from 91 providers on 29 exchanges in 24 countries at the end of June.

During June, ETFs/ETPs reported net outflows of $522 Mn. Equity ETFs/ETPs gathered net inflows of $2.99 Bn over June, bringing YTD net inflows to $50.03 Bn, lower than the $86.99 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs had net outflows of $1.69 Bn during June, bringing net inflows for the year through June 2022 to $11.35 Bn, lower than the $16.67 Bn in net inflows fixed income products had attracted by the end of June 2021. Commodities ETFs/ETPs reported net outflows of $1.52 Bn during June, bringing YTD net inflows to $6.13 Bn, higher than the $2.60 Bn in net inflows commodities products had reported year to date in 2021. Active ETFs/ETPs reported net outflows of $325 Mn over the month, gathering net inflows for the year in Europe of $389 Mn, lower than the $3.37 Bn in net inflows active products had reported in the first half of 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $8.31 Bn during June. Invesco US Treasury 7-10 Year UCITS ETF (TREX LN) gathered $940.95 Mn, the largest individual net inflow.

Top 20 ETFs by net inflows in June 2022: Europe

Name | Ticker | Assets | NNA | NNA |

TREX LN | 2,805.09 | 2,544.71 | 940.95 | |

iShares $ Corp Bond UCITS ETF | LQDE LN | 6,239.09 | 1,596.12 | 852.15 |

iShares Core S&P 500 UCITS ETF – Acc | CSSPX SW | 53,405.80 | 6,220.48 | 630.34 |

iShares $ Treasury Bond 7-10yr UCITS ETF | IBTM LN | 5,949.44 | 2,020.44 | 567.06 |

iShares MSCI China A UCITS ETF – Acc | IASH LN | 2,587.51 | 629.89 | 550.62 |

iShares MSCI Brazil UCITS ETF DE (Acc) – Acc | 4BRZ GY | 1,136.07 | 861.19 | 505.07 |

iShares $ Treasury Bond 7-10yr UCITS ETF USD (Acc) – Acc | CSBGU0 SW | 1,537.11 | 773.74 | 499.12 |

iShares Core MSCI World UCITS ETF – Acc | IWDA LN | 41,075.34 | 3,789.66 | 435.58 |

iShares EUR Corp Bond ESG Paris-Aligned Climate UCITS ETF – Acc | IPAB GY | 409.76 | 407.12 | 407.12 |

Vanguard FTSE All-World UCITS ETF | VWRD LN | 12,728.80 | 2,024.04 | 407.02 |

iShares $ Treasury Bond 20+yr UCITS ETF | IBTL LN | 2,638.69 | 1,208.85 | 315.57 |

iShares $ TIPS 0-5 UCITS ETF | TP05 LN | 1,379.58 | 392.60 | 298.04 |

Vanguard FTSE All-World High Dividend Yield UCITS ETF | VHYD LN | 3,098.39 | 1,294.07 | 291.93 |

iShares MSCI ACWI UCITS ETF – Acc | ISAC LN | 5,180.11 | 1,794.78 | 289.66 |

UBS Irl ETF plc – S&P 500 ESG UCITS ETF – Dis | S5SD GY | 2,955.06 | 1,097.21 | 228.54 |

iShares eb.rexx Money Market UCITS ETF (DE) | EBMMEX GY | 1,002.82 | 536.14 | 225.55 |

Lyxor MSCI China ESG Leaders Extra DR UCITS ETF – Acc | ASI FP | 568.11 | 346.81 | 221.90 |

Ossiam ESG Low Carbon Shiller Barclays Cape US Sector UCITS ETF – Acc | 5HEE GY | 798.59 | 327.58 | 217.13 |

AMUNDI S&P 500 UCITS ETF – EUR (C) – Acc | 500 FP | 7,463.60 | 553.28 | 215.06 |

Xtrackers CSI300 Swap UCITS ETF 1C – Acc | XCHA LN | 2,237.12 | 530.50 | 212.50 |

The top 10 ETPs by net new assets collectively gathered $785 Mn during June. iShares Physical Gold ETC – Acc (SGLN LN) gathered $449 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in June 2022: Europe

Name | Ticker | Assets | NNA | NNA |

iShares Physical Gold ETC – Acc | SGLN LN | 16,632.34 | 4077.44 | 448.81 |

WisdomTree Precious Metals – EUR Daily Hedged – Acc | 00XQ GY | 109.59 | (10.85) | 111.90 |

WisdomTree Physical Swiss Gold – Acc | SGBS LN | 3,090.19 | (604.15) | 77.22 |

WisdomTree Long JPY Short EUR – Acc | SJPS GY | 68.47 | 48.49 | 43.56 |

WisdomTree Natural Gas 3x Daily Leveraged – Acc | 3NGL LN | 12.75 | (35.04) | 24.82 |

WisdomTree Core Physical Gold – Acc | WGLD LN | 648.90 | 243.68 | 20.91 |

21Shares Bitcoin ETP – Acc | ABTC SW | 155.78 | 34.13 | 20.27 |

Leverage Shares 3x Tesla ETP – Acc | TSL3 LN | 62.11 | 117.43 | 13.21 |

CoinShares Physical Bitcoin – Acc | BITC SW | 174.22 | 40.63 | 12.42 |

BTCetc – Bitcoin ETP – Acc | BTCE GY | 307.88 | (55.14) | 11.57 |

Investors have tended to invest in Equity ETFs and ETPs during June.

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Source: ETFWorld

Subscribe to Our Newsletter