ETFGI reports that assets invested in the global ETFs industry reached a record of US$10.86 trillion at the end of July

Sign up to our free newsletters

By Deborah Fuhr, Managing Partner at ETFGI

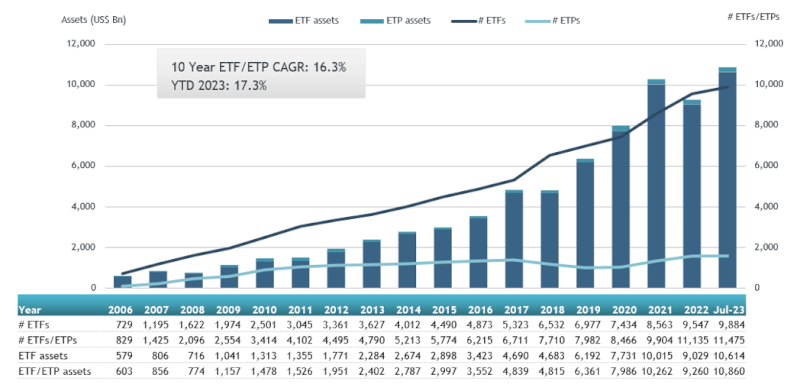

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in the global ETFs industry reached a record of US$10.86 trillion at the end of July. During July the global ETFs industry gathered US$87.16 billion in net inflows, bringing year to date net inflows to US$464.4 Bn. Assets invested in the global ETFs industry have increased 17.3% YTD in 2023, going from $9.26 trillion at end of 2022 to $10.86 trillion, according to ETFGI’s July 2023 global ETFs and ETPs industry landscape insights report. (All dollar values in USD unless otherwise noted)

Highlights

- Assets invested in the global ETFs industry reached a record of $10.86 Tn at the end of July.

- Assets have increased 17.3% YTD in 2023, going from $9.26 Tn at end of 2022 to $10.86 Tn.

- Net inflows of $87.16 Bn gathered during July.

- YTD net inflows of $464.40 Bn are the third highest on record, after YTD net inflows of $739.16 Bn in 2021 and YTD net inflows of $504.75 Bn in 2022.

- 50th month of consecutive net inflows.

“The S&P 500 increased by 3.21% in July and is up 20.65% year-to-date in 2023. Developed markets excluding the US increased by 3.62% in July and are up 15.09% YTD in 2023. Norway (up 8.97%) and Israel (up 8.06%) saw the largest increases amongst the developed markets in July. Emerging markets increased by 6.15% during July and are up 11.08% YTD in 2023. Turkey (up 20.52%) and Pakistan (up 15.89%) saw the largest increases amongst emerging markets in July.” According to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Global ETFs industry asset growth as of the end of July

At the end of July 2023, the Global ETFs industry had 11,475 products, with 23,355 listings, assets of $10.86 trillion, from 696 providers listed on 81 exchanges in 63 countries.

During July, ETFs gathered net inflows of $87.16 Bn. Equity ETFs reported net inflows of $50.75 Bn during July, bringing YTD net inflows to $212.92 Bn, significantly lower than the $289.13 Bn in net inflows YTD in 2022. Fixed income ETFs had net inflows of $25.7 Bn during July, bringing YTD net inflows to $167.68 Bn, higher than the $115.63 Bn in YTD net inflows in 2022. Commodities ETFs/ETPs reported net outflows of $3.26 Bn during July, bringing YTD net outflows to $3.53 Bn, significantly lower than the $2.97 Bn in net YTD in 2022. Active ETFs attracted net inflows of $15.26 Bn during the month, gathering YTD net inflows of $84.7 Bn, higher than the $72.12 Bn in net inflows YTD in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $52.66 Bn during July. iShares Core S&P 500 ETF (IVV US) gathered $9.91 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows July 2023: Global

Name | Ticker | Assets | NNA | NNA |

iShares Core S&P 500 ETF | IVV US | 352,722.75 | 10,330.69 | 9,906.51 |

iShares 20+ Year Treasury Bond ETF | TLT US | 43,188.06 | 16,476.45 | 4,803.91 |

Vanguard S&P 500 ETF | VOO US | 339,984.69 | 24,888.36 | 4,349.36 |

iShares Core S&P Mid-Cap ETF | IJH US | 75,773.69 | 4,385.28 | 3,705.75 |

iShares Treasury Floating Rate Bond ETF | TFLO US | 9,532.59 | 5,154.25 | 3,272.10 |

Invesco S&P 500 Equal Weight ETF | RSP US | 44,119.11 | 8,090.18 | 3,227.76 |

Vanguard Total Stock Market ETF | VTI US | 320,432.20 | 10,615.85 | 2,756.51 |

iShares Core U.S. Aggregate Bond ETF | AGG US | 94,063.77 | 10,999.14 | 2,273.46 |

Huatai-Pinebridge CSI 300 ETF | 510300 CH | 12,903.63 | 1,415.30 | 2,195.27 |

Vanguard Intermediate-Term Treasury ETF | VGIT US | 15,434.29 | 2,292.29 | 2,037.00 |

Financial Select Sector SPDR Fund | XLF US | 35,789.08 | 3,638.88 | 1,818.45 |

ChinaAMC CSI Science and Technology Innovation Board 50 ETF | 588000 CH | 10,772.39 | 3,314.02 | 1,643.51 |

iShares MSCI EAFE Value ETF | EFV US | 17,107.81 | 286.51 | 1,641.11 |

iShares S&P 500 Growth ETF | IVW US | 35,788.99 | 985.68 | 1,560.89 |

Vanguard Short-Term Corporate Bond ETF | VCSH US | 36,408.97 | (4,569.98) | 1,493.80 |

Vanguard Long-Term Treasury ETF | VGLT US | 7,377.94 | 3,467.18 | 1,327.68 |

Vanguard Total Bond Market ETF | BND US | 95,278.08 | 9,919.05 | 1,219.82 |

Invesco QQQ Trust | QQQ US | 210,601.59 | 2,058.04 | 1,207.97 |

iShares UK Gilts 0-5yr UCITS ETF | IGLS LN | 3,677.83 | 1,614.12 | 1,113.06 |

iShares 0-3 Month Treasury Bond ETF | SGOV US | 12,038.37 | 4,590.31 | 1,103.71 |

The top 10 ETPs by net new assets collectively gathered $781.28 Mn over July. BTCetc – ETC Group Physical Bitcoin – Acc (BTCE GY) and WisdomTree Precious Metals – Acc (AIGP LN) each gathered $158.41 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows July 2023: Global

Name | Ticker | Assets | NNA | NNA |

BTCE GY | 237.61 | 158.41 | 158.41 | |

WisdomTree Precious Metals – Acc | AIGP LN | 221.16 | (14.64) | 158.41 |

iPath Series B S&P 500 VIX Short-Term Futures ETN | VXX US | 403.65 | 366.58 | 80.29 |

Korea Investment & Securities TRUE 2X Natural Gas Futures ETN B 93 | 570093 KS | 158.39 | 79.20 | 79.20 |

Shinhan Securities Shinhan Bloomberg 2X Natural Gas Futures ETN 82 | 500082 KS | 114.20 | 148.10 | 57.10 |

MicroSectors FANG+ Index -3X Inverse Leveraged ETNs due January 8, 2038 | FNGD US | 170.71 | 184.76 | 56.94 |

Samsung Securities Samsung Leverage Natural Gas Futures ETN C 111 | 530111 KS | 1,124.70 | 1,077.38 | 53.59 |

MicroSectors FANG+ ETNs | FNGS US | 1,348.24 | 857.33 | 47.74 |

ProShares UltraShort DJ-UBS Natural Gas | KOLD US | 1,085.55 | 1,698.67 | 46.45 |

ProShares Ultra VIX Short-Term Futures | UVXY US | 41.54 | 33.59 | 43.17 |

Investors have tended to invest in Equity ETFs/ETPs during July.

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Source: ETFWorld

Subscribe to Our Newsletter