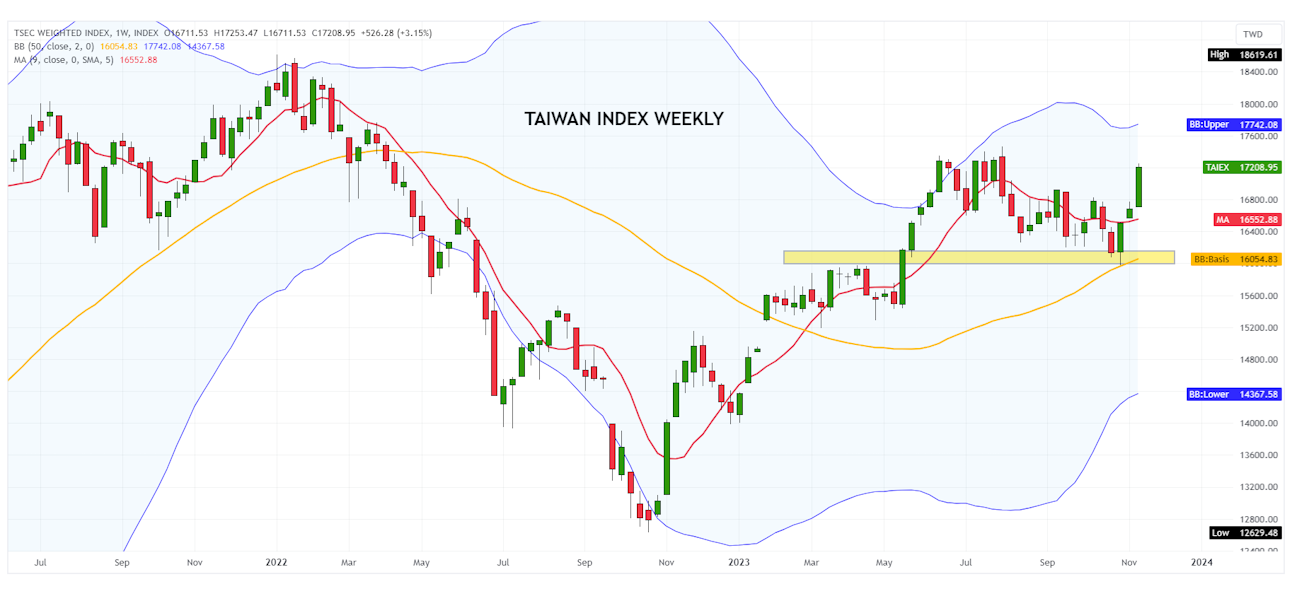

Over the past few weeks, the technical situation of the Taiwan Index has improved.

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

The Taiwan Index, having fallen back towards 16,000 points, made a quick leap forward and climbed to 17,250.

Quantitative analysis shows a clear strengthening of the bullish pressure, with the main directional indicators turning long.

After a short consolidation pause, a further extension is therefore possible, with a first target in the 17,420-17,450 point area.

The overtaking of this area will then open up further room for growth, with theoretical targets at 17,650 first and around 17,750 at a later date.

Click on the image to enlarge it.

Difficult for now to assume a bearish trend reversal: only a descent below 16,650 points, in fact, could provide a negative signal and trigger a rapid correction towards the next graphic support located in the 16,250-16,200 points area.

Click on the image to enlarge it.

The following ETFs can be used to invest in the Taiwan stock market:

Franklin Ftse Taiwan, ISIN IE000CM02H85. It is an ETF with €6m in assets under management, which provides for the total physical replication of the underlying and adopts an accumulation policy (with dividends being reinvested within the fund). The total expense ratio (TER) is 0.19% per annum.

HSBC MSCI Taiwan, ISIN IE00B3S1J086. This ETF has €22m in assets under management, physical replication of the underlying and a distribution policy (with dividends being distributed semi-annually to investors). The total expense ratio (TER) is 0.50% per annum.

Xtrackers MSCI Taiwan, ISIN LU0292109187. This ETF has €91m in assets under management, physical replication of the underlying and an accumulation policy (with dividends being reinvested within the fund). The total expense ratio (TER) is 0.65% per annum.

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

Disclaimer

The contents of these notes and the opinions expressed should in no way be regarded as an invitation to invest. The analyses do not constitute a solicitation to buy or sell any financial instrument.The purpose of these notes is financial analysis and investment research. Where recommendations are made, they are of a general nature, are addressed to an indistinct audience and lack the element of personalisation. Although the result of extensive analysis, the information contained in these notes may contain errors. Under no circumstances can the authors be held liable for any choices made by readers on the basis of such erroneous information.erroneous information. Anyone deciding to carry out any financial transaction on the basis of the information contained in the site does so assuming full responsibility.

Subscribe to Our Newsletter