ETFGI reports that assets invested in ETFs industry in Europe reached a new milestone of US$1.82 trillion at the end of 2023

Sign up to our free newsletters

By Deborah Fuhr, Managing Partner at ETFGI

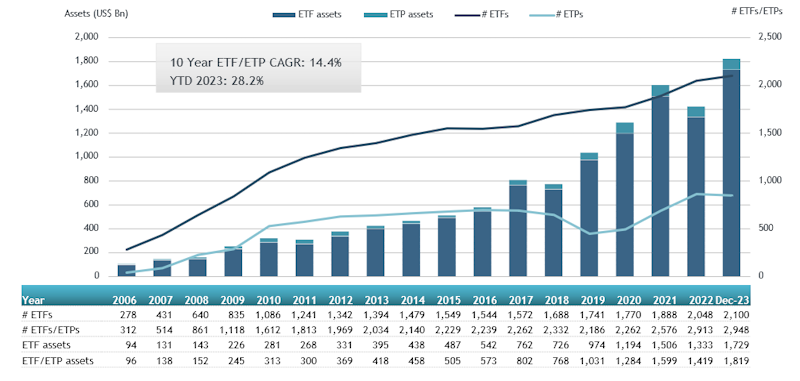

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports assets invested in the ETFs industry in Europe reached a new milestone of US$1.82 trillion at the end of 2023. Net inflows of US$17.42 billion were gathered during December, bringing 2023 net inflows to US$155.91 billion. Assets invested in the ETFs industry in Europe increased 28.2% in 2023, going from US$1.42 trillion at end of 2022 to US$1.82 trillion, according to ETFGI’s December 2023 European ETFs industry landscape insights report. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the ETFs industry in Europe reached a new milestone of $1.82 Tn at the end of 2023 beating the previous record of $1.72 Tn at the end of November 2023.

- Assets increased 28.2% in 2023, going from $1.42 Tn at end of 2022 to $1.82 Tn.

- Net inflows of $17.42 Bn in December.

- 2023 net inflows of $155.91 Bn are second highest on record after 2021 net inflows of $193.46 Bn.

- 15th month of consecutive net inflows.

“The S&P 500 increased by 4.54% in December and was up 26.29% in 2023. The developed markets index excluding the US increased by 5.81% in December and were up 18.14% in 2023. Sweden (up 12.29%) and Australia (up 10.47%) saw the largest increases amongst the developed markets in December. The emerging markets index increased by 3.63% during December and was up 10.87% in 2023. Peru (up 24.95%) and Columbia (up 12.44%) saw the largest increases amongst emerging markets in December”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Asset growth in the ETFs industry in Europe at the end of 2023

The ETFs industry in Europe had 2,948 products, with 12,001 listings, assets of $1.82 Tn, from 99 providers listed on 29 exchanges in 24 countries at the end of 2023.

During December, ETFs gathered net inflows to $17.42 Bn. Equity ETFs gathered net inflows of $14.89 Bn during December, bringing 2023 net inflows to $94.90 Bn, significantly higher than the $55.70 Bn in net inflows for 2022. Fixed income ETFs had net inflows of $4.36 Bn during December, bringing 2023 net inflows to $63.48 Bn, significantly higher than the $34.14 Bn in net inflows in 2022. Commodities ETFs/ETPs reported net outflows of $2.31 Bn during December, bringing 2023 net outflows to $9.27 Bn, much higher than the $4.67 Bn in net outflows in 2022. Active ETFs reported net inflows of $1.06 Bn for December, gathering net inflows of $7.32 Bn in 2023, much higher than the $2.75 Bn in net inflows in 2022.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $13.68 Bn during December. iShares Core S&P 500 UCITS ETF – Acc (CSSPX SW) gathered $1.21 Bn, the largest individual net inflow.

Top 20 ETFs by net inflows in December 2023: Europe

Name | Ticker | Assets | NNA | NNA |

iShares Core S&P 500 UCITS ETF – Acc | CSSPX SW | 71,742.79 | 4,556.43 | 1,214.78 |

UBS Lux Fund Solutions – Bloomberg US Liquid Corporates 1-5 Year UCITS ETF – Acc | UEF7 GY | 2,150.45 | 999.44 | 1,142.40 |

HSBC Global Government Bond UCITS ETF – Acc | HGVU LN | 5,171.60 | 1,630.84 | 1,061.93 |

UBS Lux Fund Solutions – MSCI Canada UCITS ETF (CAD) A-dis | CANCDA SW | 2,457.66 | 199.70 | 891.05 |

Xtrackers MSCI World ESG UCITS ETF – 1C – Acc | XZW0 LN | 5,286.04 | 1,686.12 | 850.16 |

iShares MSCI USA ESG Enhanced UCITS ETF | EEDS LN | 14,745.39 | 2,537.96 | 804.11 |

iShares USD Treasury Bond 0-1yr UCITS ETF | IBTU LN | 13,193.88 | 2,639.68 | 735.21 |

iShares MSCI Europe ESG Enhanced UCITS ETF | EEUD LN | 4,870.75 | 1,467.58 | 685.05 |

iShares Core € Corp Bond UCITS ETF | IEBC LN | 18,060.45 | 5,244.13 | 651.13 |

iShares Core MSCI World UCITS ETF – Acc | IWDA LN | 65,781.73 | 9,255.83 | 620.17 |

Xtrackers II EUR Overnight Rate Swap UCITS ETF – 1C – Acc | XEON GY | 5,276.08 | 3,808.88 | 553.88 |

Xtrackers Euro Stoxx 50 UCITS ETF (DR) – 1D | XESX GY | 7,098.56 | 864.42 | 535.26 |

Vanguard S&P 500 UCITS ETF | VUSA LN | 45,330.93 | 3,511.48 | 530.10 |

iShares MSCI Europe UCITS ETF EUR (Acc) – Acc | SMEA LN | 7,070.65 | 1,633.65 | 500.18 |

iShares MSCI EMU ESG Enhanced UCITS ETF | EMUD LN | 2,157.20 | 1,118.50 | 491.14 |

SPDR MSCI World UCITS ETF – Acc | SPPW GY | 4,501.56 | 1,956.97 | 489.03 |

iShares S&P 500 Equal Weight UCITS ETF – Acc | EWSP LN | 1,719.23 | 977.20 | 488.25 |

Xtrackers MSCI Europe ESG UCITS ETF – 1C – Acc | XZEU GY | 1,908.36 | 546.46 | 484.89 |

SPDR S&P 500 UCITS ETF | SPY5 GY | 8,078.93 | 1,783.69 | 482.50 |

HSBC MSCI World UCITS ETF | HMWO LN | 7,776.93 | 2,024.56 | 467.12 |

The top 10 ETPs by net new assets collectively gathered $1.13 Bn during December. Invesco Physical Gold ETC – GBP Hdg Acc (SGLS LN) gathered $423.60 Mn the largest individual net inflow.

Top 10 ETPs by net inflows in December 2023: Europe

Name | Ticker | Assets | NNA | NNA |

Invesco Physical Gold ETC – GBP Hdg Acc | SGLS LN | 1,172.65 | 1,031.35 | 423.60 |

Xtrackers IE Physical Gold ETC Securities – Acc | XGDU LN | 3,165.40 | (608.29) | 240.98 |

Xtrackers Physical Gold ETC (EUR) – Acc | XAD5 GY | 1,962.46 | (418.61) | 192.04 |

iShares Physical Silver ETC – Acc | SSLN LN | 518.74 | 14.51 | 67.40 |

WisdomTree WTI Crude Oil – Acc | CRUD LN | 734.28 | (74.65) | 54.00 |

CoinShares Physical Bitcoin – Acc | BITC SW | 614.20 | 149.25 | 44.00 |

WisdomTree Brent Crude Oil – Acc | BRNT LN | 1,603.15 | 262.67 | 38.21 |

21Shares Bitcoin Core ETP | CBTC SW | 59.33 | 46.51 | 28.71 |

WisdomTree Physical Platinum – Acc | PHPT LN | 384.46 | (47.85) | 23.26 |

WisdomTree Natural Gas 3x Daily Leveraged – Acc | 3NGL LN | 62.95 | 214.99 | 22.30 |

Investors have tended to invest in Equity ETFs during December.

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Source: ETFWorldSubscribe to Our Newsletter