Cyclical Analysis : Let’s examine insights from key indicators derived from the Implied Volatility and Options markets in the U.S., the world’s leading financial market.

By Eugenio Sartorelli – www.investimentivicenti.it

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

Starting with the classic Implied Volatility Index, the VIX (daily data from June 2023 to May 1 close):

This indicator typically moves inversely to the S&P500, peaking sharply during market lows—hence its nickname, the “fear index.”

Recently, the VIX spiked to nearly 52 points on April 8 (see blue arrow), its highest level since March 2020. Concurrently, the S&P500 hit a significant low (red arrow). The trigger for this volatility was the U.S. threat of tariffs on major global economies.

Currently, the VIX has dropped sharply to around 25 points, well below historically high thresholds. A further decline toward the psychological 20-point level—the long-term average—would signal even greater stability. Overall, sentiment is improving markedly.

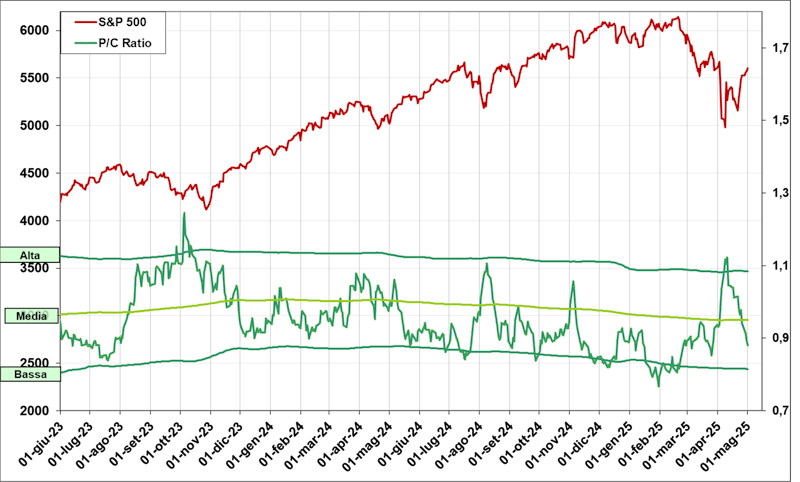

Next, another sentiment indicator from the options market: the Put/Call Ratio (daily data):

The Put/Call Ratio is also a contrarian indicator, similar to the VIX. The chart shows the Total Ratio, which includes volumes for both S&P500 index options and single-stock options. An 8-period exponential moving average smooths the data.

This ratio also peaked on April 9 (green arrow), aligning with the S&P500’s low. Its subsequent sharp decline now places it well below long-term averages, reinforcing the narrative of normalization and a shift from risk-off to risk-on sentiment.

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

Disclaimer

The contents of these notes and the opinions expressed should in no way be regarded as an invitation to invest. The analyses do not constitute a solicitation to buy or sell any financial instrument.The purpose of these notes is financial analysis and investment research. Where recommendations are made, they are of a general nature, are addressed to an indistinct audience and lack the element of personalisation. Although the result of extensive analysis, the information contained in these notes may contain errors. Under no circumstances can the authors be held liable for any choices made by readers on the basis of such erroneous information.erroneous information. Anyone deciding to carry out any financial transaction on the basis of the information contained in the site does so assuming full responsibility.

Subscribe to Our Newsletter