Cyclical Analysis: On 20 June at 4 p.m., the Leading Economic Index® (LEI) linked to the US economy and created by the Conference Board, a non-profit organisation that has been conducting independent analysis mainly on the US for 100 years, was released.

By Eugenio Sartorelli – www.investimentivicenti.it

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

This leading indicator should provide a slight advance warning of the main trends in the US economy, with a lead time of around 6-7 months.

The 10 components of the Leading Indicator Index are:

– Average weekly hours in manufacturing

– Average weekly initial claims for unemployment insurance

– Manufacturers’ new orders for consumer goods and materials

– ISM® Index of New Orders

– Manufacturers’ new orders for non-defence capital goods excluding aircraft orders

– Building permits for new private housing units

– S&P 500® Index of Stock Prices

– Leading Credit Index™

– Interest rate spread (10-year Treasury bonds less federal funds rate)

– Average consumer expectations for business conditions.

Then there is the Coincident Indicator, which aims to provide a snapshot of the current economic phase; the data monitored are:

– Payroll employment

– Personal income less transfer payments

– Manufacturing and trade sales

– Industrial production.

These four data points are strongly correlated with GDP, which is the main indicator of the economic cycle.

At this point, all that remains is to look at the results (monthly data):

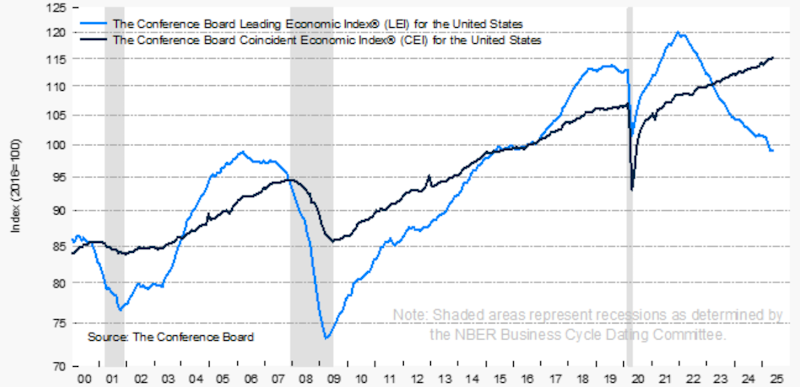

Figure 1: US Leading Economic Index (blue line); US Coincident Economic Index (black line).

Looking at the two curves, we can see that there is a high correlation with the Leading Economic Index (Lei), which in fact tends to anticipate the Coincident Economic Index (Cei), especially at turning points.

All this worked until April 2022 (see blue arrow), when the Leading Index began to fall continuously and inexorably, and even the latest data remains negative. It is striking that this Leading indicator is at lower levels than during the pandemic phase in spring 2020.

Even more surprising is that the US Coincident Economic Index (CEI) has continued to grow unabated since spring 2020 and has not been significantly affected by the decline in the LEI.

I would say that two conclusions can be drawn.

The first is that the Leading Economic Index (LEI) needs to be revised in terms of its composition, as it is clear that it is not at all in line with the US economic trend. Probably one of the main causes of this disconnect has been the large amount of liquidity injected into the US and global economy by the Central Bank and the Government during the pandemic. This excess liquidity is difficult to “regulate” and is having long-term effects on the economy and finance.

The second conclusion is also linked to intermarket analysis, whose main parameters, linked to correlations between the main asset classes, have largely changed since 2020. It almost seems as if some of the classic economic “rules” have been invalidated. We may therefore be entering a phase of new economic rules, which are yet to be studied and defined.

The alternative is that we may return to more classic economic rules, which have governed the markets for decades. In this case, the US economy (Coincident Indicator) is more likely to follow what the Leading Indicator has been signalling for three years, namely that there may be at least a sharp slowdown by the end of this year.

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

Disclaimer

The contents of these notes and the opinions expressed should in no way be regarded as an invitation to invest. The analyses do not constitute a solicitation to buy or sell any financial instrument.The purpose of these notes is financial analysis and investment research. Where recommendations are made, they are of a general nature, are addressed to an indistinct audience and lack the element of personalisation. Although the result of extensive analysis, the information contained in these notes may contain errors. Under no circumstances can the authors be held liable for any choices made by readers on the basis of such erroneous information.erroneous information. Anyone deciding to carry out any financial transaction on the basis of the information contained in the site does so assuming full responsibility.

Subscribe to Our Newsletter