Cyclical Analysis: In this article, we attempt to examine the current relationships between the trend of the S&P500 Index and the price of Gold. We will also briefly touch upon the strength of the Dollar (Dollar Index).

By Eugenio Sartorelli – www.investimentivincenti.it

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

The most frequent intermarket relationship between these two markets should be more neutral. At the economic cycle level, the stock index should make highs (or lows) before the peak (or trough) of the economy; Gold more often tends to do so well after, due to its correlation with interest rates (which tend to fall after the economic peak) and its historical role as a hedge during phases less favorable to risk (risk-off).

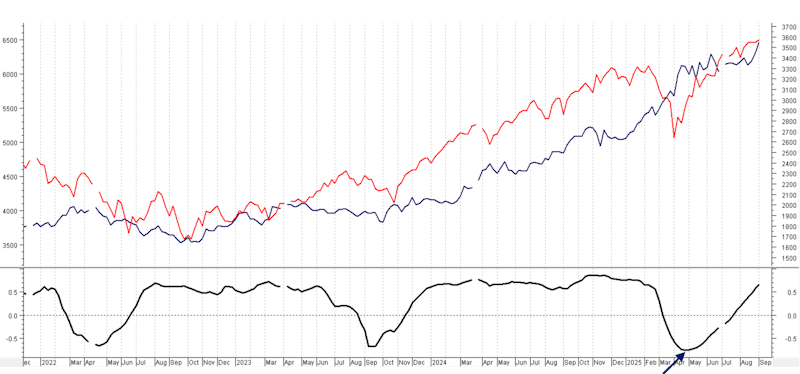

Let’s look at the trend, using weekly data, of the S&P500 Index (red line – left scale) and Gold (black line – right scale), updated as of the afternoon of September 5th:

The chart below shows the correlation between the two charts, calculated over 26 data points (i.e., 6 months), which we know can oscillate between -1 and 1. For simplicity, this correlation is based on prices, which better highlights the cyclical phases; more precisely, it should be done on percentage changes.

As can be seen, this correlation has been positive most of the time since late 2021, with only three brief negative phases. Therefore, the correlation is quite different from what classical theory suggests. Recently, there was a negative correlation (see blue arrow) that lasted from March to mid-July of this year. Currently, the correlation has returned decisively positive and in line with the recent past.

It is difficult to provide definitive explanations. Especially for the current phase, we know there is a situation of tension regarding Bond yields in general; this is despite lower interest rates in Europe and more slowly declining rates in the US. These fears reduce the appeal of bonds, and investors favor equities (especially US ones) as well as Gold and Silver, as physical assets with evident intrinsic value. It should be noted that the strength of the Dollar (Dollar Index) has been in sharp decline since the beginning of the year, and this also contributes to supporting Gold (and Silver as well). As an additional motivation, we have that there is always high liquidity, favored especially by the policies of the US administration and by growing public debt in many countries.

Just to make a hypothesis about the future trend of these two markets, let’s assume the correlation remains positive. The S&P500 and Gold are at all-time highs, and this trend could continue for a few more weeks, let’s say until after the expected Fed rate cut (September 17th). Then, there might be a consolidation phase for both markets, with a trading range or a slight correction. Further growth, especially for Gold, could occur particularly if there is further deterioration in sentiment regarding the bond market.

Just to also provide perspectives on the Dollar, it is expected to continue its weakening (thus also against the Euro), both due to the Fed’s rate cut (perhaps 2 by the end of the year) and because this is the desire of the current US administration.

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

Disclaimer

The contents of these notes and the opinions expressed should in no way be regarded as an invitation to invest. The analyses do not constitute a solicitation to buy or sell any financial instrument.The purpose of these notes is financial analysis and investment research. Where recommendations are made, they are of a general nature, are addressed to an indistinct audience and lack the element of personalisation. Although the result of extensive analysis, the information contained in these notes may contain errors. Under no circumstances can the authors be held liable for any choices made by readers on the basis of such erroneous information.erroneous information. Anyone deciding to carry out any financial transaction on the basis of the information contained in the site does so assuming full responsibility.

Subscribe to Our Newsletter