Vanguard : Europe-domiciled ETFs enjoyed record-setting inflows in 2025. That momentum shifted up a gear in January.

Head of index equity and ETF product specialism, Vanguard Europe

- Europe-domiciled ETFs attracted $55.9 billion of assets in January, with both equity and bond ETFs seeing strong inflows.

- Equity ETFs collected $43.8 billion in new assets, while fixed income exposures saw $13.1 billion of net inflows.

- The Vanguard UCITS ETF range captured net inflows of $5.1 billion in January, with the majority recording positive flows.

Monthly recap: Unprecedentedly strong flows to start the year

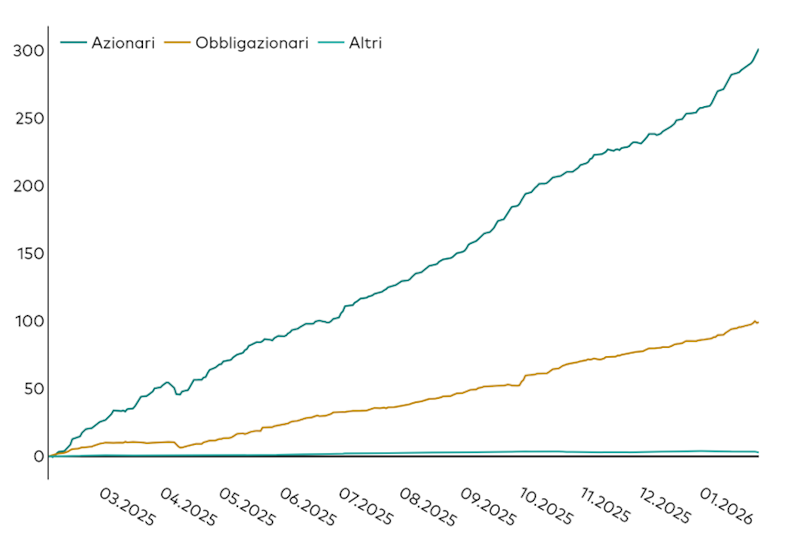

In 2025, investors allocated into Europe-domiciled ETFs at a record pace. In the first month of 2026, demand for ETFs shifted up a gear, as the pace of flows accelerated to a level not seen last year – or any other year. The total monthly net inflows in January, of $55.9 billion, were $10 billion higher than any single month in 20251.

Despite patches of volatility, as markets digested geopolitical tensions, we saw an increase in risk appetite – reflected in broadly rising equity markets but more subdued fixed income returns. In this environment, investors poured $43.8 billion into equity ETFs in January. (For those keeping score, the monthly average in 2025 for the equity ETF category was $23.2 billion.) Core equity ETFs were a key driver of flows in January, with investors favouring global and developed market equity ETF exposures.

While fixed income ETFs picked up $13.1 billion of net inflows in January, that was still higher than all but one month (October) in 2025. Across bond ETFs, investors showed a preference for government and ultra-short maturity exposures. On a regional basis, global, euro area and US fixed income ETFs all saw healthy net inflows in January.

Multi-asset ETFs enjoyed net inflows in January, while alternative and commodity ETFs endured net outflows.

Total ETF market flows

ETF demand stronger than ever

European ETF cumulative flows – cumulative 12 months by asset class ($ billion)

Source: ETFbook, as at 31 January 2026.

Equity ETFs

Core equity ETFs finish strong

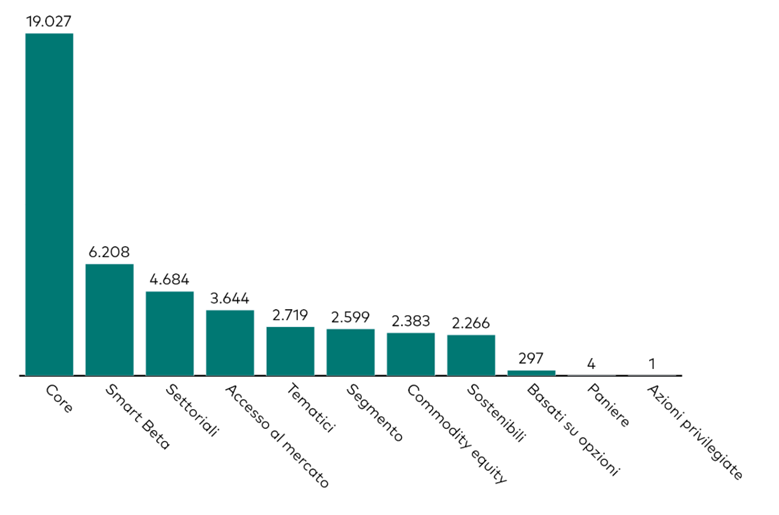

Equity flows by category: Month to date ($ million)

Source: ETFbook, as at 31 January 2026. The ‘segment’ category includes equity exposures which target specific market capitalisation segments, such as small-cap, mid-cap and large-cap. The ‘market access’ category includes difficult-to-access markets such as emerging markets. The ‘basket’ category includes strategies that combine several stocks as the underlying exposure.

Core equity ETFs continued to attract strong net inflows, adding $19.0 billion in January. For context, that total surpasses every monthly haul of 2025. Smart beta equity ETFs saw $6.2 billion of net inflows last month while sector ETFs added $4.7 billion. We saw no outflows across the equity ETF categories we track.

Broad regional equity ETFs in demand

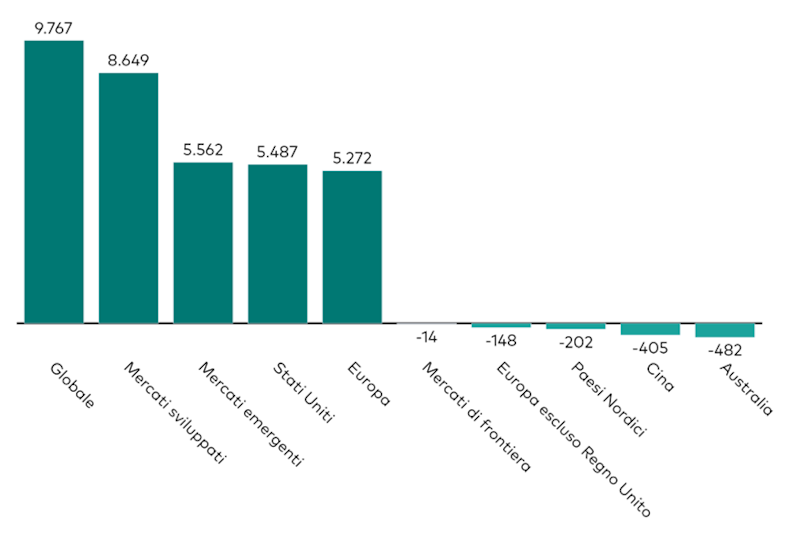

Equity flows by geographic exposure: Month to date ($ million)

Source: ETFbook, as at 31 January 2026.

Global equity ETFs topped the table, adding $9.8 billion of net inflows in January – higher than any single month in 2025. Developed market equity ETFs followed closely behind, gathering $8.6 billion of inflows last month. Emerging market, US and Europe equity ETFs also enjoyed a healthy start to the year. We saw relatively modest net outflows in January, as Australia and China equity ETFs weathered outflows of -$482 million and -$405 million, respectively.

Fixed income ETFs

Government bond ETFs see strong net inflows

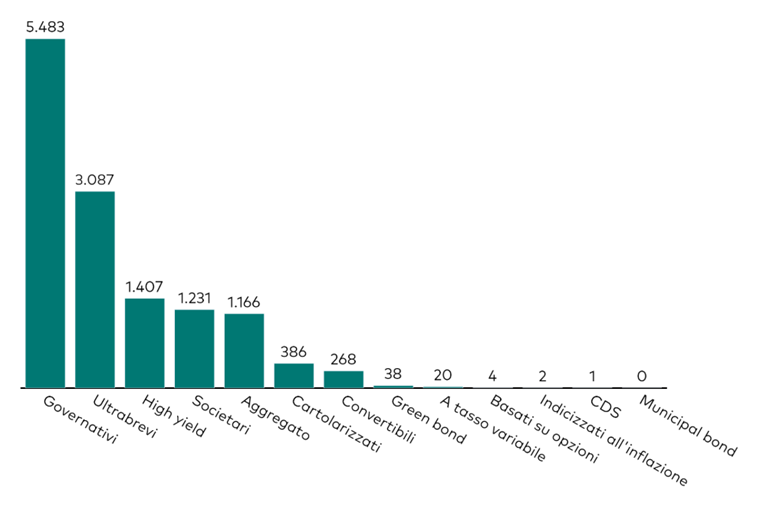

Fixed income flows by category: Month to date ($ million)

Source: ETFbook, as at 31 January 2026.

In yet another example of the heady pace of ETF flows we’ve seen, government bond ETFs welcomed $5.5 billion of net inflows in January, higher than each month for the category last year. Ultra-short maturity bond ETFs picked up $3.1 billion of net inflows last month, while high-yield, corporate and aggregate bond ETFs also saw investor demand. We observed no net outflows across the fixed income ETF categories that we track.

Global bond ETFs set the pace in January

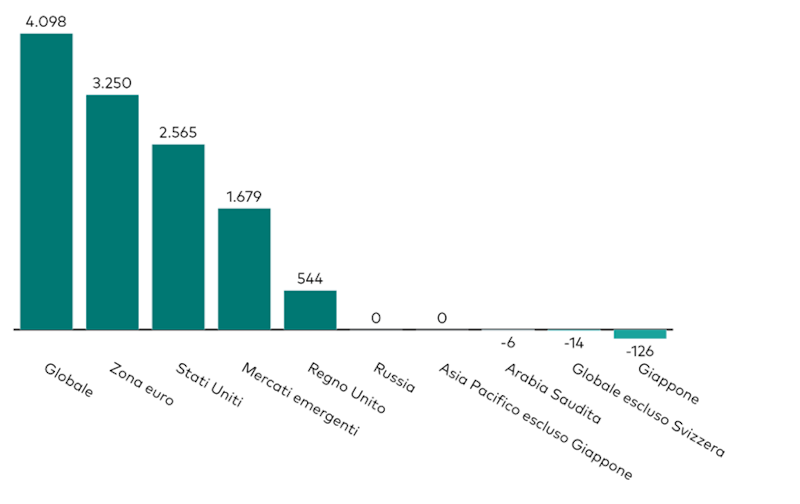

Fixed income flows by geographic exposure: Month to date ($ million)

Source: ETFbook, as at 31 January 2026.

Global bond ETFs finished January with $4.1 billion of net inflows, while euro area and US bond ETFs added $3.3 billion and $2.6 billion of net inflows, respectively. Emerging market bond ETFs also began the year well, with $1.7 billion of net inflows. On the other side of the ledger, Japan bond ETFs weathered -$126 million of net outflows.

Vanguard UCITS ETFs

Vanguard range sees net inflows of $5.1 billion in January

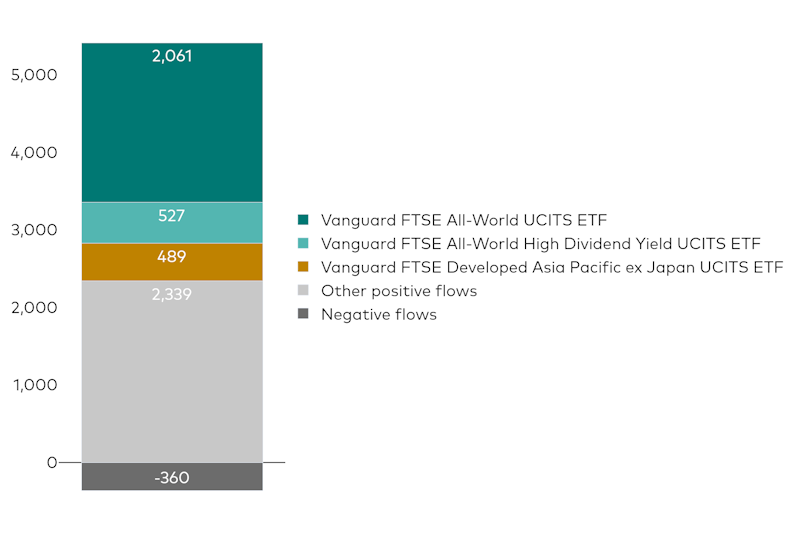

Vanguard UCITS ETF net flows: Month to date ($ million)

Source: ETFbook, as at 31 January 2026.

The Vanguard UCITS ETF range captured net inflows of $5.1 billion in January, with the majority recording positive flows. Inflows were split between Vanguard’s equity ETF range ($3.4 billion) and fixed income ETF range ($1.5 billion), while the multi-asset ETF range ($94 million) and cash ETF range ($32 million) also saw net inflows.

1 Net inflows were $45.1 billion in September 2025 and $45.6 billion in October 2025. No other month in 2025 topped $40 billion.

Source: ETFWorld.co.uk

Subscribe to Our Newsletter