Cyclical Analysis: Let’s see what some indicators derived from the Implied Volatility and Options market on the world’s main market, the US, can tell us.

By Eugenio Sartorelli – www.investimentivincenti.it

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

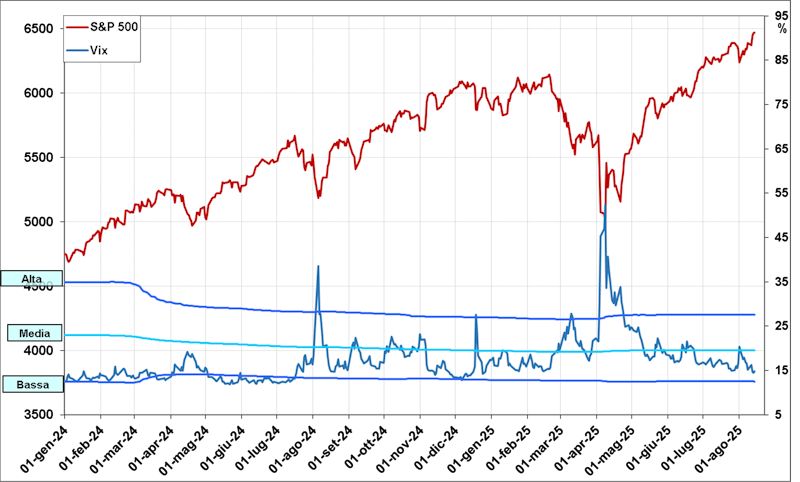

Let’s start with the classic Implied Volatility Index, the VIX (daily data from January 2024 to August 14):

This indicator has the classic contrarian trend relative to the S&P500 Index and, most importantly, makes very pronounced peaks corresponding to market lows, as can be easily seen from the chart; this is why it is also called the “fear index.”

Recently, the VIX made a relative high on August 1st (see blue arrow) with values around 20 points, which are around a long-term average. This was followed by a decline, and we are currently around 14.8 points, which are annual lows.

The S&P500 Index made a relative low also on August 1st (see red arrow) around 6240 points. Sentiment therefore remains positive.

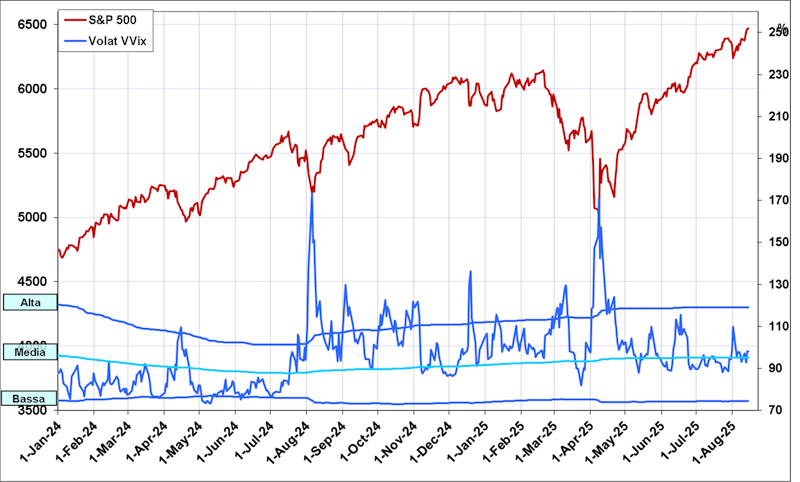

Let’s also look at another sentiment indicator related to Volatility: the VVIX chart (daily data):

The VVIX Index is related to the Volatility of the VIX Index, on which one can trade using futures and options. The VVIX Index has characteristics similar to the VIX, but it can be an amplifier of Volatility and sometimes a leading indicator.

Here too, the VVIX reached a fairly high peak on August 1st (see blue arrow) coinciding with the S&P500 low. Subsequently, the VVIX fell but has not managed to drop below its long-term average.

This lack of synchronization with the VIX is probably due to the fact that many professional operators prefer to hedge against the risk of sudden increases in Volatility, which we know can happen in August.

In fact, the statistics for VIX movements in August are as follows:

Aug | |

Average Change | +8,4% |

% of Up Years | 57% |

% of Down Years | 43% |

Copyright DMF New Media – ETFWorld.co.uk

Reproduction prohibited in any form, even partial

Disclaimer

The contents of these notes and the opinions expressed should in no way be regarded as an invitation to invest. The analyses do not constitute a solicitation to buy or sell any financial instrument.The purpose of these notes is financial analysis and investment research. Where recommendations are made, they are of a general nature, are addressed to an indistinct audience and lack the element of personalisation. Although the result of extensive analysis, the information contained in these notes may contain errors. Under no circumstances can the authors be held liable for any choices made by readers on the basis of such erroneous information.erroneous information. Anyone deciding to carry out any financial transaction on the basis of the information contained in the site does so assuming full responsibility.

Subscribe to Our Newsletter