ETFGI reports that assets invested in the Global ETFs industry reached a new milestone of US$12.25 Tn at the end of February

Sign up to our free newsletters

By Deborah Fuhr, Managing Partner at ETFGI

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reports assets invested in the global ETFs industry reached a new milestone of US$12.25 Tn at the end of February. During February the global ETFs industry gathered US$116.30 billion in net inflows, bringing year to date net inflows to US$253.04 billion, according to ETFGI’s February 2024 global ETFs and ETPs industry landscape insights report. (All dollar values in USD unless otherwise noted)

Highlights

- Assets invested in the global ETFs industry reached a new milestone of $12.25 Tn at the end of February beating the previous record of $11.73 Tn at the end of January 2024.

- Net inflows of $116.30 Bn during February.

- YTD net inflows of $253.04 Bn are the highest, the second highest YTD net inflows was $224.30 Bn in 2021 and the third highest was 182.44 Bn in 2022.

- 57th month of consecutive net inflows.

“The S&P 500 index increased by 5.34% in February and is up by 7.11% YTD. Developed markets excluding the US increased by 1.90% in February and are up 1.58% YTD. Ireland (up 8.60%) and Israel (up 8.27%) saw the largest increases amongst the developed markets in February. Emerging markets increased by 4.18% during February and are up 0.57% YTD. China (up 8.41%) and Peru (up 7.12%) saw the largest increases amongst emerging markets in February”, according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

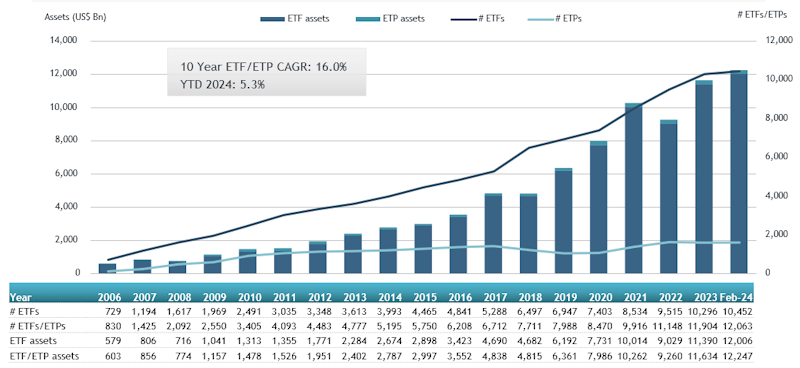

Global ETFs industry asset growth as of the end of February

![]()

The Global ETFs industry had 12,063 products, with 24,216 listings, assets of $12.25 Tn, from 735 providers listed on 80 exchanges in 63 countries at the end of February.

During February, ETFs gathered net inflows of $116.30 Bn. Equity ETFs reported net inflows of $80.40 Bn during February, bringing YTD net inflows to $141.48 Bn, higher than the $20.24 Bn in net YTD in 2023. Fixed income ETFs had net inflows of $14.28 Bn during February, bringing YTD net inflows to $44.38 Bn, higher than the $32.58 Bn in net inflows YTD in 2023. Commodities ETFs/ETPs reported net outflows of $3.85 Bn during February, bringing YTD net outflows to $7.45 Bn, lower than the $966.33 Mn in net inflows YTD in 2023. Active ETFs attracted net inflows of $21.53 Bn during the month, gathering YTD net inflows of $46.12 Bn, higher than the $24.93 Bn in net inflows YTD in 2023.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $63.64 Bn during February. Vanguard S&P 500 ETF (VOO US) gathered $6.47 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows February 2024: Global

Name | Ticker | Assets | NNA | NNA |

Vanguard S&P 500 ETF | VOO US | 415,632.82 | 16,310.05 | 6,467.13 |

Vanguard Information Technology ETF | VGT US | 69,869.54 | 6,393.13 | 5,709.15 |

iShares Core S&P 500 ETF | IVV US | 441,511.29 | 17,140.23 | 5,160.17 |

iShares Bitcoin Trust | IBIT US | 10,009.46 | 7,769.26 | 4,969.22 |

China CSI 500 ETF – Acc | 510500 CH | 10,684.25 | 3,802.67 | 4,028.45 |

China AMC CSI 300 Index ETF | 510330 CH | 13,030.41 | 7,209.48 | 3,761.86 |

Harvest CSI 300 Index ETF – Acc | 159919 CH | 14,139.49 | 7,837.25 | 3,541.06 |

E Fund CSI 300 ETF | 510310 CH | 16,316.94 | 8,996.53 | 3,419.42 |

Vanguard Intermediate-Term Treasury ETF | VGIT US | 25,118.57 | 3,805.69 | 3,377.48 |

Huatai-Pinebridge CSI 300 ETF | 510300 CH | 26,134.98 | 7,350.13 | 3,061.85 |

SPDR Portfolio S&P 500 ETF | SPLG US | 32,162.82 | 4,419.51 | 2,981.11 |

Vanguard Total Stock Market ETF | VTI US | 373,538.38 | 5,421.10 | 2,698.20 |

Fidelity Wise Origin Bitcoin Fund | FBTC US | 6,471.90 | 4,800.11 | 2,296.22 |

China Southern CSI 1000 ETF – Acc | 512100 CH | 3,325.11 | 1,771.12 | 2,054.74 |

SPDR S&P 500 UCITS ETF | SPY5 GY | 11,746.83 | 3,029.84 | 1,894.20 |

E Fund ChiNext Price Index ETF | 159915 CH | 8,308.93 | 2,672.52 | 1,768.36 |

Amundi MSCI USA ESG Climate Net Zero Ambition CTB UCITS ETF | USA FP | 3,641.42 | 1,669.72 | 1,688.31 |

Vanguard Total Bond Market ETF | BND US | 105,550.84 | 2,902.79 | 1,655.43 |

iShares Core U.S. Aggregate Bond ETF | AGG US | 101,640.34 | 2,096.53 | 1,592.21 |

iShares Core MSCI World UCITS ETF – Acc | IWDA LN | 72,334.26 | 2,853.95 | 1,515.42 |

![]()

The top 10 ETPs by net new assets collectively gathered $1.11 Bn over February. MERITZ SECURITIES MERITZ KIS CD RATE ETN 63 (610063 KS) gathered $290.47 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows February 2024: Global

Name | Ticker | NNA | NNA | NNA |

610063 KS | 700.99 | 290.47 | 290.47 | |

United States Natural Gas Fund LP | UNG US | 869.11 | (11.69) | 221.07 |

WisdomTree Copper – Acc | COPA LN | 1,530.73 | 269.34 | 144.00 |

Alerian MLP Index ETNs due January 28 2044 | AMJB US | 108.60 | 105.26 | 105.26 |

Xtrackers IE Physical Gold ETC Securities – Acc | XGDU LN | 3,193.92 | 64.15 | 77.73 |

ProShares Ultra DJ-UBS Natural Gas | BOIL US | 584.62 | 87.84 | 75.32 |

21Shares Ethereum Staking ETP – Acc | AETH SW | 583.34 | 60.08 | 68.36 |

Samsung Securities Samsung Leverage Natural Gas Futures ETN C 111 | 530111 KS | 146.61 | 48.87 | 48.87 |

iShares Physical Gold ETC – Acc | SGLN LN | 13,551.01 | (39.53) | 44.41 |

Leverage Shares 3x Tesla ETP – Acc | TSL3 LN | 202.26 | 77.78 | 31.82 |

![]()

Investors have tended to invest in Equity ETFs/ETPs during February.

ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

Source: ETFWorld

Subscribe to Our Newsletter