LSEG Data & Analytics: December 2024 was another month with strong inflows for the European ETF industry.

Sign up to our free newsletters

By Detlef Glow,

In fact, the inflows marked a new all-time high for monthly inflows into ETFs in Europe. These inflows occurred in a mainly positive market environment. While most equity markets were on the rise despite the high valuations of the market leaders over the course of the month, some bond segments faced the impacts from rising rates as yield curves have somewhat started to normalize. This might also be the reason why investors are somewhat nervous and reacting quickly on any news that may impact the current market environment negatively. That said, the election of Donald Trump as the next U.S. president had a positive impact on the U.S. equity market and the U.S. dollar.

That said, investors are not only focusing on economic news, as the increasing geopolitical tensions in the Middle East—especially the developments around the Red Sea—are seen as a risk for the general economic growth in Western countries since these tensions have the potential to drive up the price of oil. In addition, a number of shipping companies these days avoid the passage of the Suez channel. It is, therefore, to be expected that prolonged delivery times will cause some tensions for the still vulnerable delivery chains.

Market sentiment was also further driven by the expectations of investors for future central bank decisions. Since the different regions of the world are showing different growth patterns, investors expect less activity from the U.S. Federal Reserve, while they expect much more interest rate cuts from the European Central Bank. As a result, such different central bank activity may lead to a stronger U.S. dollar compared to the euro and other leading currencies. With regard to this, any statement from the Fed and other central banks may have the power to move the bond market in one or the other direction. In addition, fears of increasing debt in the U.S. might be the driver for further increasing interest rates on the long end of the yield curve, which hold back inflows into medium and long-term bond ETFs, while the still inverted yield curves might be the drivers for the inflows into money market ETFs.

That said, inverted yield curves and especially long-term inverted yield curves are seen as an early indicator for a possible recession. However, there are no signs for a recession in the U.S. and most other major economies visible yet. But even as it looks like the yield curves are slowly normalizing, this does not mean that there is no recession possible in the major economies around the globe. This is especially true as some major economies lack economic growth and may need lower interest rates as stimulus. Despite these headwinds, the positive effects of lower interest rates seem to be more important for investors than the current state of some economies.

From an ETF industry perspective, the performance of the underlying markets led, in combination with the estimated net flows, to increasing assets under management (from €2,065.4 bn as of November 30, 2024, to €2,081.8 bn at the end of December). At a closer look, the increase in assets under management of €16.4 bn for December was driven by estimated net inflows, which contributed €31.3 bn to the growth of assets under management, while the performance of the underlying markets (-€14.9 bn) had a negative impact on the assets under management.

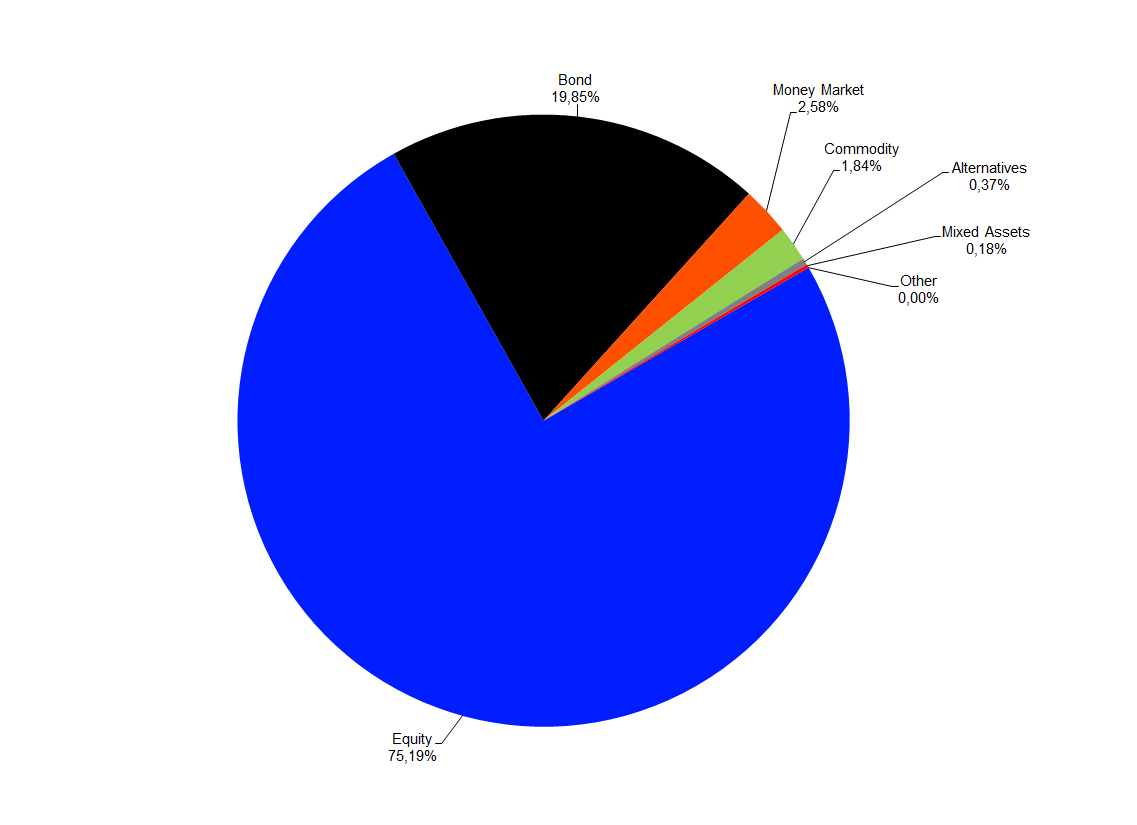

As for the overall structure of the European ETF industry, it was not surprising equity funds (€1,1565.2 bn) held the majority of assets, followed by bond funds (€413.2 bn), money market products (€53.6 bn), commodities products (€38.3 bn), alternatives products (€7.6 bn), and mixed-assets funds (€3.8 bn).

Given the current market environment, it is no surprise that the overall assets under management in the European ETF industry (€2,081.8 bn) are going from one all-time high to the next month after month. With regard to this, it is no surprise that the assets under management for equity, bond, and money market ETFs also marked an all-time high at the end of the month.

Graph 1: Market Share, Assets Under Management in the European ETF Segment by Asset Type, December 31, 2024

Source: LSEG Lipper

ETF Flows by Asset Type

The European ETF industry enjoyed strong estimated net inflows (+€31.3 bn) over the course of December which marked a new all-time-high for monthly flows into ETFs in Europe. These flows were way above the rolling 12-month average (€21.4 bn). These inflows drove the overall inflows in ETFs up to €256.4 bn for the year 2024. This marks an all-time for the annual inflows into ETFs in Europe.

The inflows in the European ETF industry for December were driven by equity ETFs (+€27.4 bn), followed by money market ETFs (+€3.1 bn) bond ETFs (+€1.8 bn), and mixed-assets ETFs (+€0.1 bn). On the other side of table, alternatives ETFs (-€0.03 bn) and commodities ETFs (-€1.1 bn) shed money.

Source: ETFWorld

Subscribe to Our Newsletter