Refinitiv: The European ETF industry enjoyed healthy inflows over the course of December 2023. These inflows occurred in an increasingly unstable market environment since the geopolitical tensions in Middle East, especially the Red Sea, increased over the course of the month.

Sign up to our free newsletters

By Detlef Glow, Lipper’s head of EMEA research at Refinitiv

Nevertheless, some asset classes showed positive results while others performed negatively. Market sentiment was further driven by hopes that central banks—especially the U.S. Federal Reserve—have reached the last phase of their fight against high and further increasing inflation rates given their rather dovish statements during/after the respective central bank meetings in December. Some investors already expected that there might be room for decreasing interest rates early next year, which might be reflected by the estimated inflows in bond ETFs. Despite the dovish statements by the central banks, these estimates might be under scrutiny since inflation in the major economies seems to be more sticky than expected and central banks are held responsible to reach their inflation targets. This could mean that the expected rate cuts start later than investors expect. In addition, there are still some concerns about the outcome of geopolitical tensions in the Red Sea since the actions taken by the Houthi rebels have the power to disrupt the still vulnerable delivery chains. In addition, there are still some concerns about the possibility of a recession in the U.S. and other major economies around the globe. These fears have been raised by long-term inverted yield curves, which are seen as an early indicator for a possible recession. The normalization of inverted yield curves might be another short-term challenge for the bond markets.

The performance of the underlying markets led, in combination with the estimated net inflows, to increasing assets under management (from €1,501.5 bn as of November 30, 2023, to a new all -time-high of €1,563.5 bn at the end of December). At a closer look, the increase in assets under management of €62.0 bn for December was driven by the performance of the underlying markets (+€44.6 bn), while the estimated net inflows contributed (+€17.3 bn) to the increase in assets under management.

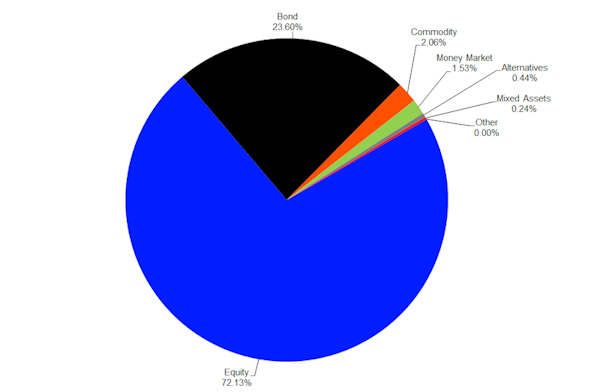

As for the overall structure of the European ETF industry, it was not surprising equity funds (€1,127.8 bn) held the majority of assets, followed by bond funds (€369.0 bn), commodities products (€32.3 bn), money market products (€23.9 bn), alternatives products (€6.8 bn), and mixed-assets funds (€3.8 bn).

It is noteworthy that the assets under management in bond, equities, and money market ETFs reached a new all-time high at the end of December 2023.

Graph 1: Market Share, Assets Under Management in the European ETF Segment by Asset Type, December 31, 2023

Source: LSEG Lipper

Fund Flows by Asset Type

The European ETF industry enjoyed estimated net inflows (+€17.3 bn). These flows were far above the rolling 12-month average (€13.0 bn).

The inflows for December drove the overall estimated net flows in the European ETF industry up to +€155.6 bn. This means that the European ETF industry missed a new record for estimated inflows despite the strong inflows in December. Nevertheless, 2023 was the second-best year on record with regard to the estimated net flows for the European ETF industry.

The inflows in the European ETF industry for December were driven by equity ETFs (+€13.8 bn), followed by bond ETFs (+€2.7 bn), money market ETFs (+€1.5 bn), and mixed-assets ETFs (+€0.01 bn). On the other side of the table, alternatives ETFs (-€0.05 bn) and commodities ETFs (-€0.6 bn) faced outflows for December 2023.

Source: ETFWorld

Subscribe to Our Newsletter