Refinitiv: The European ETF industry enjoyed inflows over the course of July 2023. These inflows occurred in an unstable market environment over the course of the month in which some asset classes nevertheless showed positive results while others performed negatively.

Sign up to our free newsletters

By Detlef Glow, Lipper’s head of EMEA research at Refinitiv

The market sentiment was still driven by hopes that central banks—especially the U.S. Federal Reserve—may have reached the last phase of their fight against high and further increasing inflation rates and may, therefore, start to keep interest rates at least stable quite soon. Some investors already expect that there might be room for decreasing interest rates later this year which might be reflected by the estimated inflows in bond ETFs. Nevertheless, there are still some concerns about geopolitical tensions and the still ongoing normalization of the disrupted delivery chains as well as a still possible recession in the U.S. and other major economies around the globe. These fears are raised by inverted yield curves which are seen as an early indicator for a possible recession.

The performance of the underlying markets led in conjunction with the estimated net inflows to increasing assets under management (from €1,410.3 bn as of June 30, 2023, to €1,451.8 bn at the end of July). At a closer look, the increase in assets under management of €41.5 bn for July was driven by the performance of the underlying markets (+€25.7 bn), while the estimated net inflows contributed (+€15.8 bn) to the growth in assets under management.

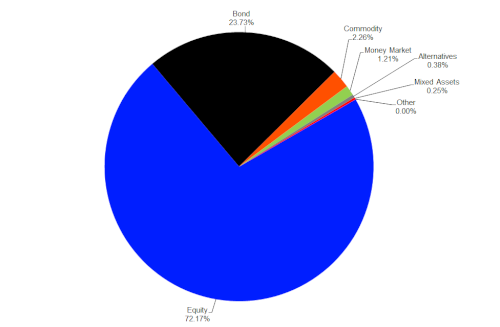

As for the overall structure of the European ETF industry, it was not surprising equity funds (€1,014.0 bn) held the majority of assets, followed by bond funds (€344.5 bn), commodities products (€32.8 bn), money market products (€17.5 bn), alternative UCITS products (€5.6 bn), and mixed-assets funds (€3.7 bn).

Graph 1: Market Share, Assets Under Management in the European ETF Segment by Asset Type, July 31, 2023

Source: LSEG Lipper

Fund Flows by Asset Type

The European ETF industry enjoyed estimated net inflows (+€15.8 bn). These flows were way above the rolling 12-month average (€9.2 bn).

The inflows in the European ETF industry for July were driven by bond ETFs (+€7.3 bn), followed by equity ETFs (+€7.1 bn), money market ETFs (+€1.3 bn), commodities ETFs (+€0.2 bn), and mixed-assets ETFs (+€0.1 bn). On the other side of the table, alternative UCITS ETFs (-€0.1 bn) faced outflows for July 2023.

Source: ETFWorld

Subscribe to Our Newsletter