WisdomTree : Crypto’s next phase is not about survival or price discovery. It is about implementation.

Sign up to our free newsletters

Dovile Silenskyte, Director, Digital Assets Research, WisdomTree

As we head into 2026, the edge no longer comes from spotting the next narrative. It comes from treating crypto as a portfolio allocation: accessed cleanly, sized deliberately and governed with discipline.

For investors who approach it this way, crypto is increasingly less exotic and more usable.

Why this matters now

Crypto has moved on from its retail-led, boom-bust adolescence. Infrastructure largely works, regulation is tightening rather than retreating and capital is behaving more like institutional capital.

This changes the rules of engagement.

The key shift is subtle but decisive as the debate has moved from “Should we own crypto?” to “How do we implement it responsibly?”

This matters in today’s macro context, where traditional diversification is under strain: inflation risk has proven persistent, fiscal dominance is re-emerging, equity–bond correlations have become unreliable, and investors lack differentiated return drivers.

Three themes shaping institutional crypto allocations

- Institutional normalisation accelerates

Crypto is becoming more predictable in how it is accessed and governed.

- Crypto exchange traded products (ETPs) have embedded digital assets into institutional infrastructure, enabling exposure through familiar, convenient wrappers.

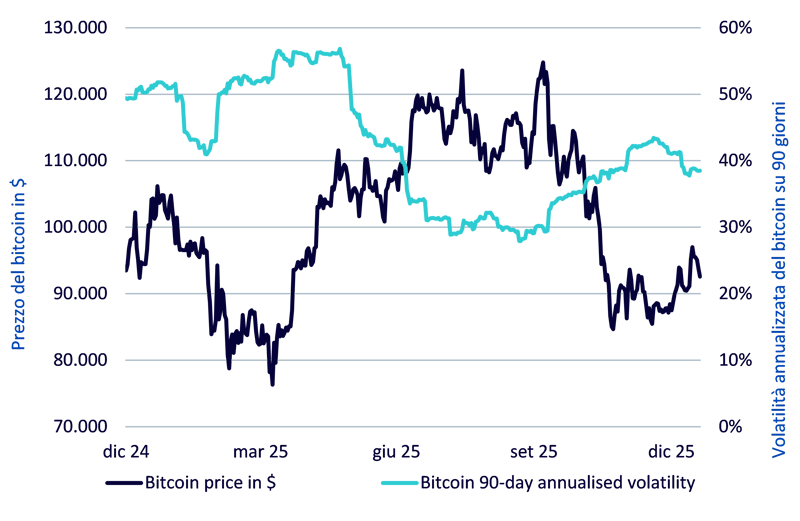

- Volatility has compressed at the margin, particularly for bitcoin, as ownership consolidates among longer-term, institutionally aligned holders.

- Regulation is acting as a filter, not a kill switch, concentrating capital into assets and structures that meet governance, custody and transparency standards.

Figure 1: As bitcoin ownership consolidates into institutional hands, its realised volatility compresses

| Category | Number of bitcoins | Per cent of total bitcoin supply |

| ETPs | 1,502,560 | 7.2% |

| Public companies | 1,108,080 | 5.3% |

| Governments | 647,042 | 3.1% |

| Decentralised finance (DeFi) | 372,377 | 1.8% |

| Private companies | 288,012 | 1.4% |

| Exchanges/custodians | 145,993 | 0.7% |

| Total | 4,064,064 | 19.4% |

Source: Bitcoin Treasuries, Artemis Terminal. 19 January 2026. Bitcoin total supply is 21,000,000. Historical performance is not an indication of future performance, and any investment may go down in value.

This is what happens as asset classes mature: narrative gives way to function, while access and governance begin to matter as much as upside.

Allocator takeaway: implementation quality increasingly drives outcomes, not just asset selection.

- Income moves to centre stage

The long-standing ‘no yield’ objection to crypto is fading.

Staking has turned parts of the market from pure beta exposure into total return assets. Crucially, this income is protocol-native rather than leverage-driven or credit-dependent.

- Ether increasingly resembles productive digital capital, combining usage-linked fees, staking income and fee-burn mechanics.

- Liquid staking removes operational friction, turning staking into an investment decision rather than a technology project.

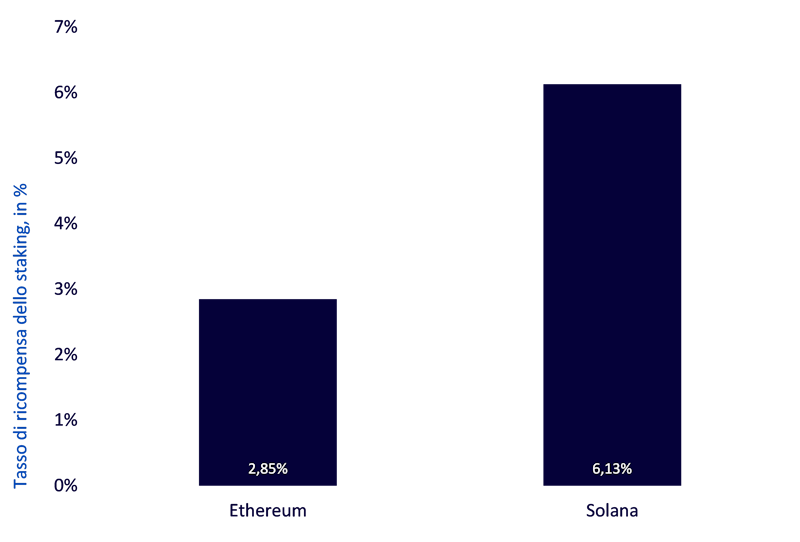

- Solana offers higher headline staking yields, but with higher inflation and greater sensitivity to adoption cycles.

Figure 2: Staking reward comparison

Source: Staking Rewards. 20 January 2026. Historical performance is not an indication of future performance, and any investment may go down in value.

Portfolio implication: layered crypto income. Ethereum anchors on depth and institutional maturity, while Solana introduces cyclical, higher-beta income exposure. Income does not eliminate volatility, but it changes the return profile and the investor behaviour around it.

- Portfolio integration deepens

Crypto is migrating out of the ‘alternatives’ bucket and into mainstream asset-allocation discussions, alongside gold, commodities and other diversifiers.

A growing body of academic and practitioner research suggests that small, disciplined allocations can improve portfolio efficiency over full cycles. Outcomes remain regime-dependent and implementation-sensitive, but the diversification case is no longer theoretical.

- Bitcoin is increasingly analysed as a non-sovereign, scarcity-driven asset, sensitive to confidence in fiat systems rather than realised inflation alone.

- Asymmetry works only with discipline: small sizing, systematic rebalancing and no momentum chasing.

- Governance is decisive. Good governance captures volatility, while poor governance magnifies risk.

Figure 3: Small bitcoin allocations have historically improved portfolio risk/return metrics

| 60/40 Global Portfolio | 1% Bitcoin Portfolio | 3% Bitcoin Portfolio | 5% Bitcoin Portfolio | 10% Bitcoin Portfolio | MSCI AC World | Bloomberg Multiverse | Bitcoin | |

| Annualised Return | 6.40% | 7.01% | 8.23% | 9.44% | 12.43% | 9.83% | 1.01% | 48.75% |

| Volatility | 8.76% | 8.83% | 9.12% | 9.57% | 11.30% | 13.90% | 4.99% | 65.30% |

| Sharpe Ratio | 0.52 | 0.59 | 0.70 | 0.80 | 0.94 | 0.58 | -0.16 | 0.72 |

| Information Ratio | 0.93 | 0.93 | 0.92 | 0.92 | ||||

| Sortino Ratio | 0.63 | 0.71 | 0.86 | 0.98 | 1.20 | 0.68 | -0.22 | 0.97 |

| Beta | 69% | 71% | 73% | 75% | 80% | 100% | 24% | 178% |

Source: Bloomberg, WisdomTree. From 31 December 2013 to 31 December 2025. Based on daily USD returns. The 60/40 Global Portfolio is composed of 60% MSCI All Country World and 40% Bloomberg Multiverse. You cannot invest directly in an index. Historical performance is not an indication of future performance, and any investment may go down in value.

Crypto rewards allocators, not traders.

Beyond single tokens: why structure is overtaking selection

As governance scrutiny increases, portfolio construction is overtaking token selection.

Rules-based crypto basket ETPs directly address two persistent investor errors:

- Overconfidence: single-token bets dressed up as strategy.

- Paralysis: doing nothing because the market feels too complex.

Crypto baskets introduce index discipline, diversification and systematic rebalancing. They sacrifice lottery outcomes in exchange for repeatable, risk-adjusted participation.

This mirrors the evolution of equity investing itself, from stock picking to structured exposure, and reflects where crypto is heading as it integrates into portfolios.

Risks and reality checks

None of this removes risk. Crypto remains volatile, sentiment-driven at times and exposed to regulatory and technological uncertainty, with correlations rising sharply in stress regimes and staking returns not guaranteed.

The case for crypto in 2026 is not maximal exposure, but optimal exposure.

The key takeaway

Crypto in 2026 is increasingly defined by integration. The objective is not to maximise exposure, but to allocate at a level that is meaningful while remaining consistent with overall portfolio risk.

For investors focused on access, sizing and governance, crypto is becoming an asset class that can be held, monitored and rebalanced within a broader portfolio framework.

The opportunity is therefore less about belief and more about disciplined implementation.

Subscribe to Our Newsletter